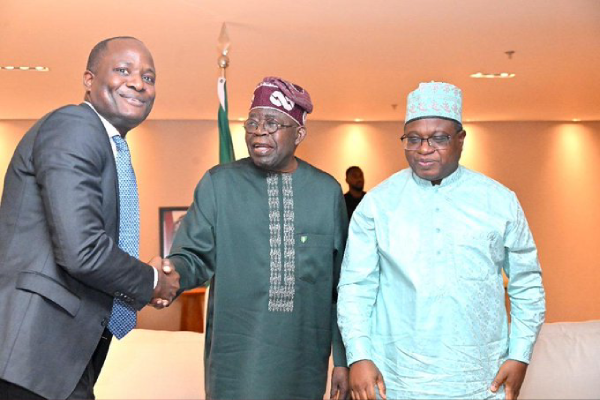

Nigeria’s President Bola Ahmed Tinubu hosted the Nigerian Exchange Group (NGX Group) Board and the Director-General of the Securities and Exchange Commission (SEC) during his state visit to Brazil, underscoring the administration’s focus on capital market growth and investor confidence.

President Tinubu praised the remarkable growth of Nigeria’s capital market since the beginning of his tenure, citing increased trading volumes, higher market capitalization, and improved regulatory compliance.

“Our markets must be a trusted engine of enterprise and prosperity. My government will continue to pursue reforms that unlock capital, protect investors, and drive innovation,” he said.

The meeting also highlighted the importance of the Investment and Securities Act (ISA) 2025, described by SEC Director-General Dr. Emomotimi Agama as a comprehensive legal framework designed to strengthen market governance, transparency, and investor protection.

NGX Chairman Umaru Kwairanga noted that trading volumes have nearly tripled since the current administration began. He emphasized the need for faster listing of state-owned enterprises like NNPC Limited, and proposed tax incentives to encourage investment in small and medium-sized enterprises (SMEs).

NGX Group CEO Temi Popoola discussed efforts to attract foreign investors, particularly from Brazil, highlighting a signed MoU with Brazil’s BNDES to enhance agricultural financing and support MSME investment. The CEO also noted that NGX’s market capitalization has grown to approximately $90 billion, signaling Nigeria’s increasing role as a gateway for cross-border investment in Africa.

The meeting represents Nigeria’s broader efforts to integrate its capital markets with global economies, strengthen financial regulation, and create more opportunities for private-sector growth. Analysts say this is a critical step toward achieving sustainable economic development while boosting investor confidence at home and abroad.

Why This Matters

- Investor Confidence

- President Tinubu’s meeting with NGX and SEC officials signals stability and commitment to reform, which encourages both local and foreign investors to participate in Nigeria’s capital markets.

- Confidence in the market can drive higher investments, more IPOs, and increased liquidity, benefiting the economy.

- Economic Growth & Diversification

- Listing state-owned enterprises (like NNPC Limited) and expanding SME access to capital can create jobs, stimulate entrepreneurship, and diversify income sources beyond oil.

- Partnerships with Brazil in agriculture, energy, and technology open new economic avenues and bilateral trade opportunities.

- Financial Inclusion

- With reforms and new market products (like the Growth Board), more Nigerians can participate in investing, not just institutional or wealthy investors.

- Small and medium enterprises (SMEs) gain access to funding and financial tools, helping them scale operations.

- Global Integration

- Strengthening ties with Brazil and other international markets helps Nigeria attract foreign capital, adopt global best practices, and improve regulatory standards.

- This positions Nigeria as a reliable investment hub in Africa, enhancing its regional and international credibility.

- Policy Significance

- The ISA 2025 framework ensures that growth happens safely and transparently, reducing risks of fraud, mismanagement, and market instability.

- Clear rules and investor protections encourage sustainable long-term development, rather than short-term speculative gains.